The most successful innovators I work with have one thing in common — they aren’t chasing every shiny idea that walks through the door. They’re running disciplined portfolios, applying proven frameworks that structure how ideas are generated, evaluated, and executed.

Random experimentation feels like innovation. Systematic portfolio management is innovation.

Why Most Innovation Efforts Stall

Here’s a pattern I see repeatedly in enterprise organizations: leadership greenlights ten innovation initiatives, resources get spread thin across all of them, and twelve months later, none have meaningfully progressed. The problem isn’t ambition — it’s the absence of a framework to make deliberate choices.

Innovation without structure is just expensive brainstorming.

The Framework Dominating 2022 Strategic Conversations

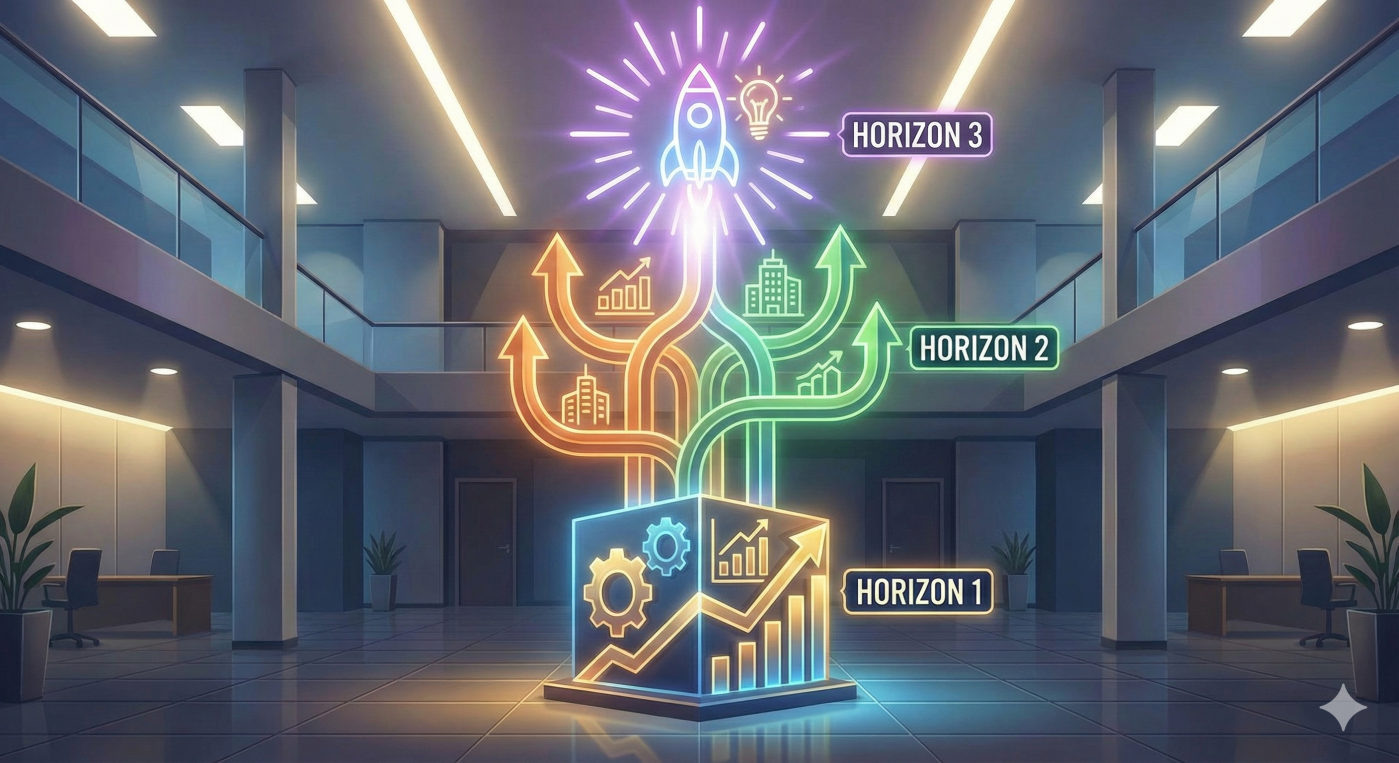

The one framework consistently showing up in my leadership engagements right now is the McKinsey 3 Horizon Framework — and for good reason. It gives organizations a practical language to categorize, prioritize, and fund innovation in a balanced way.

Here’s how the three horizons break down:

- Horizon 1 — Optimize the Core (70–80% of resource allocation): Initiatives that defend and extend the current business. These are your revenue-generating engines today. They need continuous investment to remain competitive.

- Horizon 2 — Expand to Adjacent Opportunities (15–20%): Emerging businesses or capabilities that build on existing strengths. These are your growth bets for the next 2–3 years.

- Horizon 3 — Transform with Disruptive Ideas (<5%): Long-range, high-risk ideas that could redefine your industry or create entirely new markets. Small allocation, but strategically critical to keep alive.

The organizations excelling at innovation aren’t just running H1 or swinging for H3 moonshots. They maintain a balanced portfolio across all three — and they’re ruthlessly disciplined about which horizon each initiative belongs in.

Discipline Is the Real Differentiator

What separates the winners from the rest isn’t the quality of their ideas. It’s their willingness to say no to the wrong ones.

The leaders I work with who are furthest ahead ask a fundamentally different question. Not “How many ideas can we pursue?” but “Which ideas align with our strategic direction while maintaining a balanced innovation portfolio?” That shift — from volume to alignment — is where the real leverage lives.

Portfolio discipline means:

- Explicit allocation targets per horizon, not vague intent

- Separate governance and funding models for H1, H2, and H3 — because managing a core optimization initiative the same way you manage a disruptive bet is a recipe for killing both

- Regular portfolio reviews where initiatives can be moved, accelerated, or stopped — not just added to

A Practical Note for Founders

If you’re building a product for enterprise customers, understanding where your solution fits in their innovation portfolio changes everything about how you sell.

Ask yourself: Are you helping them optimize their H1? Expand into their H2? Or are you the disruptive H3 bet they’re hedging? Each answer demands a completely different go-to-market approach, a different stakeholder, and a different conversation.

Frame your solution in terms of their portfolio balance — and you’ll immediately sound less like a vendor and more like a strategic partner.

Where does your organization invest most of its innovation energy — and is it deliberate or by default? I’d love to compare notes. Let’s keep learning — together.

Share your thoughts